Buying a home can often seem like a long, tedious process, but it all becomes worth the effort when you finally have a house to your name. However, there is one final step to complete before you can actually claim this property as your own. Registering your property is crucial because it gives you legal rights over it. Many homeowners delay the property registration process as they can pay their home loan and even move into the new house without having to register it. However, not doing so will leave you vulnerable to property disputes and prevent you from selling it later on as you will not be registered as the lawful property owner of the house.

According to section 17 of the Property Registration Act of 1908, a person will not be able to claim any legal right over a property unless it has been duly registered in their name. Registering the property is one of the most important things first-time home buyers need to know before investing since it may lead to legal hassles later on. As registering property can be expensive, many owners tend to put this off until later, claiming that they don’t have the required funds at present. But this will be a mistake in the long run because the amount payable as registration fees is calculated based on the current value of the property. By delaying the property registration process, you might have to pay a lot more later as the property appreciates. Getting your property registered in your name will also protect you from property disputes and allow you to sell it later on.

Property Registration Procedure

Registering your property is a very straightforward procedure as long as you do your research and have the required documents in place. Here are all the steps involved in the house registration process.

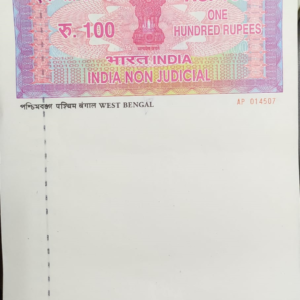

- Calculate Amount Payable as Stamp Duty

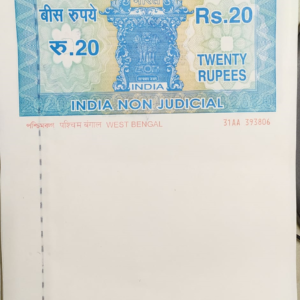

Stamp duty is a form of tax that is levied by the state government and is one of the most important elements of the property registration process. As the rate of stamp duty is decided by the state governments, it can vary between different states. It is either calculated as the current circle rate as specified by the state authorities or as a percentage of the total property value of the house, whichever of the two is higher. Typically the stamp duty in urban areas are higher than the stamp duty in rural parts of the state. Additionally, stamp duty for women is lower in an effort to encourage more women to become property owners.

2. Prepare the Sales Deed

A sales deed is one of the most important documents in the registration process. A legally valid sales deed needs to be typed on stamp paper which can purchased through a vendor or on an e-stamp paper which can be downloaded online. As it is a legal document, you will need to get a good lawyer to draft it on your behalf. Once the deed has been drafted and signed, the submission of documents to the sub-registrar should not exceed four months from this date of execution.

3.Collect Required Documents

When you meet your sub-registrar to register your property, there are certain documents they will need to check first. Having these documents ready can help the process go quickly and smoothly.

- Government-approved ID and address proof

- No Objection Certificate (NOC) for the property

- Passport size photographs of the owner of the property and of two witnesses

- Latest receipt for tax payment

- Latest account statement from bank if still paying home loan on the property

- Building plan that has been sanctioned by the concerned authorities

- Title deeds of land owner

- Cash or demand draft to pay stamp duty

You should also double check the documents with your lawyer to see if they are valid and if you need any additional documents as well. As legitimate property-related documents provided by your builder are very important to register your property.

4.Make an Appointment With the Sub-Registrar

Registration of property can only be done in the presence of the sub-registrar within which the jurisdiction of the property in question falls under. The property owner who has signed the sales deed documents needs to be present along with two witnesses.

5. Payment of Registration Fees

After the sub-registrar checks the documents and stamp duty paid for validity, you will be asked to pay the registration fees. If you have booked an appointment within four months of signing the sales deed, then the registration fee is 1.5% of the total value of the property . If you have exceeded four months, you can petition the sub-registrar to still consider your case, however, you will be asked to pay a hefty fine. Sometimes, this fan can even be 10 times more than the original registration fee.

6. Collecting Registered Documents

Once the sub-registrar approves the documents, they will give you back the registered original documents. They will keep a copy of the originals to maintain property ownership records. The registered documents will have the book and page number where the registration of property details are recorded.

A home is an investment of a lifetime, therefore, you need to protect your asset from fraud and disputes. Once you have registered your house under your name, no one can dispute your legal claim over it or prevent you from selling the property later. This is why first time homebuyers should ensure that the registration of property is completed as soon as they have received the handover.

Related Post:

Related Book:

![Honey trap in Cybercrime: A to Z guide Exploring Honey Trap in Cyberspace [With Video]](https://www.lawhousekolkata.com/wp-content/uploads/Post-Images/Honey-Trap-300x169.jpg)